Warning: to improve your experience, we suggest accessing this page from your computer. On cell phones, it is best viewed horizontally.

Even though Brazil is internationally recognized for having one of the most renewable energy matrices in the world and a leading role in climate negotiations, the country is also one of the largest oil producers in the world. Supported by a strong and historic subsidy policy, Brazil is expanding its oil production.

Inesc’s analysis results reveal that fiscal support for renewables is still much lower when compared to fossils. Between 2018 and 2022, while the Brazilian government allocated US$ 69.8 billion for fossils, for renewables it was only US$ 12.7 billion. During that period, subsidies for fossil fuels grew 64.61%, while subsidies for renewables increased 11.63%.

Select the desired value to interact with on the graph.

There are three different sets of values for the subsidies:

(IPCA) R$: values in constant Reais, corrected by the Extended National Consumer Price Index (IPCA) of December 2022.

R$: values in current (nominal) Reais, without inflation correction.

Dollar: values in US Dollars. Exchange rate of the first day of December of each year (Central Bank of Brazil calculator).

Note: The numbers for 2019 and 2020 are outliers, caused by the implementation of Repetro-Sped from 2017 onwards. This movement forced products previously registered with Repetro to migrate and re-register with Repetro-Sped by 2020, causing double counting. This process was completed in 2020, which justifies the drop in values for 2021.

What are subsidies for energy sources?

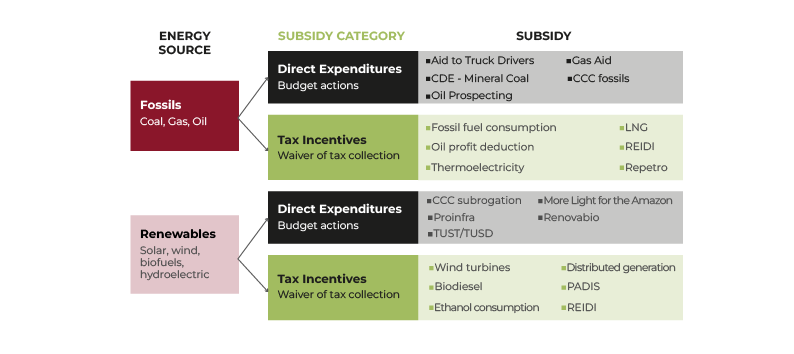

Subsidies for energy sources are government resources allocated to support or expand energy production and consumption, through tax waivers and direct budgetary expenditures. Such subsidies can finance the production of fossil fuels (mainly oil, natural gas, and coal) or renewable fuels (wind, solar, biomass, among others).

Why do we monitor?

Inesc monitors these subsidies to encourage debate about government support and to press for reform. Even with the climate crisis intensifying, countries continue to finance the expansion of fossil energy around the world with huge resources. The year 2022 was a record year for subsidies, since subsidies and investments in fossil fuels globally reached, for the first time in history, 1.4 trillion dollars.

Subsidies details

Inesc compiles data from 22 subsidies (11 fossil and 11 renewable), dividing them between direct budgetary expenditures and tax waivers, which are reductions or exemptions from taxes paid by companies and individuals for energy consumption and production. See the summary table on how Federal support for the expansion of Brazil’s energy matrix is organized:

Inesc is inspired by the methodology developed by the OECD and makes adaptations to the Brazilian energy and tax scenario. A complete explanation of the data sources used, their extraction methodologies and the criteria for selecting the subsidies presented here can be found in our Methodological Note.

The 22 subsidies presented are very different from each other. While some have existed for a long time, as is the case with Repetro (from 1999) and Proinfa (from 2002), others were created to deal with emergency situations, such as the Payment of Assistance to Independent Cargo Transporters provided in 2022. In the following graphs, it is possible to select each subsidy and check the values received throughout the historical series.

Fossil subsidies

In the last five years, US$ 69.8 billion in fossil subsidies were granted. See below the historical data and description of each one of them.

Click on the name of each subsidy to learn more about it:

Existing within the Energy Development Account (CDE), the CCC serves the generation of electrical energy in isolated systems, that is, in areas that are not integrated into the National Interconnected System (SIN). The account operates in three ways: I) reimbursement: II) admission of debt contracts and III) subrogation. The CCC finances both renewable and fossil energy, and in this methodology the values are split between them.

Repetro allows the import or acquisition of raw materials, packaging materials and intermediate products for the manufacture of products intended for the oil and natural gas industry in the domestic market with the exemption of collection of federal taxes (IPI, II, PIS/Pasep, Cofins).

Law No. 13.586/2017, which renewed and extended Repetro by 2040, also brought the possibility of deduction, for the purposes of determining the calculation basis of the Social Contribution on Net Profits (CSLL), of the amounts invested in the exploration and production of oil and natural gas deposits, considering the depletion expense arising from the asset.

Reidi encourages the implementation of infrastructure projects through exemptions for contributions to PIS/Pasep and Cofins for the acquisition, rental, and import of goods and services linked to approved projects. Even though Reidi is connected to various economic sectors, in this methodology only the energy sector is examined, and the subsidies are divided between renewable and fossil.

Exemption for the import of liquefied natural gas intended for electricity generation from the following taxes: Contribution to the Worker’s Social Integration/Public Servant Asset Formation Program (PIS/Pasep) and Social Contribution for the Financing of Social Security (Cofins).

Conduction of geological and geophysical studies, surveys and services mainly to identify areas and blocks to be offered in future public tenders.

Exemption from Contribution to the Worker’s Social Integration/Public Servant Asset Formation Program (PIS/Pasep) and Social Contribution for the Financing of Social Security (Cofins) rates levied on revenue arising from the sale of natural gas and mineral coal intended for the production of electrical energy.

Reduction in rates (Cide, PIS/Pasep and Cofins) levied on operations conducted with diesel oil, liquefied petroleum gas (LPG) and gasoline (type C).

The subsidy was created in 2022 to mitigate the impact of the price hike in liquefied petroleum gas (LPG) on the budgets of low-income families. Beneficiary families received an amount in cash corresponding to a portion of at least 50% of the average national reference price for a thirteen-kilogram LPG cylinder.

Payment of Assistance to Autonomous Cargo Transporters is made to the aforementioned duly registered professionals as a way of compensating for the increase in prices that occurred in 2022. Drivers received up to six installments, which could reach R$ 1,000.00 each. The benefit was terminated in December 2022.

Existing within the Energy Development Account (CDE), CDE – Coal is an energy policy for the use of domestic coal, providing an economic subsidy for the entire production chain, from coal exploration to electricity generation, for a certain group of plants that were in operation in 1998.

Repetro is the main subsidy for oil and gas production in Brazil and represented U$ 34.1 billion in the period or 41% of total federal energy subsidies. It exempts from taxes the importation and internal production of machinery and equipment for the exploration and production of oil and natural gas.

COFINS – Contribution to the Financing of Social Security

II – Import Tax

IPI – Tax on Industrialized Products

PIS – Social Integration Program

Note: The numbers for 2019 and 2020 are outliers, caused by the implementation of Repetro-Sped from 2017 onwards. This movement forced products previously registered with Repetro to migrate and re-register with Repetro-Sped by 2020, causing double counting. This process was completed in 2020, which justifies the drop in values for 2021.

In addition to the waivers that the sector receives through Repetro when importing or purchasing internally, companies can deduct these amounts applied in the exploration and production activities of oil and natural gas deposits to determine the profit for calculating the Corporate Income Tax (IRPJ) and Social Contribution on Net Profit (CSLL). These deductions were estimated by Inesc at US$ at US$ 6,91 billion between 2018 and 2022. The faster the rate of resource extraction, the greater the discounts.

In 2022, consumption subsidies increased by 234%, from US$ 2.5 to US$ 8.3 billion, mainly due to the waivers associated with the reduction of social contributions and the CIDE-Fuels tax used to respond to the external shock in energy prices caused by the war between Russia and Ukraine.

Subsidies for Renewable Energy

Renewable energies received US$ 12.7 billion between 2018 and 2022 and are mainly related to the generation of electrical energy. The largest subsidy is the Incentive Program for Alternative Electrical Energy Sources (Proinfra), a subsidy that expands the generation of renewable sources in the energy matrix and cost the public coffers US$ 980.8 million in 2022.

The subsidy for distributed generation saw significant growth in 2022. This is because the approval of Law 14300/2022, which established the legal framework for microgeneration and distributed mini-generation in the country, generated a demand for the installation of new (mainly solar) projects, ensuring, until 2045, full exemption from tax incentives for this type of production.

Energy production receives the majority of subsidies aimed at renewable sources. Of these, half are incentives through direct budgetary expenditures. However, 99% are budgetary expenses originating from electricity consumers, that is, charged in the form of electricity tariffs.

Click on the name of each subsidy to learn more about it:

Subsidizes the increased participation of renewable sources in the production of electrical energy. Proinfa costs are shared among all consumers served by the National Interconnected System (SIN).

Reidi encourages the implementation of infrastructure projects through exemptions for contributions to PIS/Pasep and Cofins for the acquisition, rental, and import of goods and services linked to approved projects. Even though Reidi is connected to various economic sectors, in this methodology only the energy sector is examined, and the subsidies are divided between renewable and fossil.

Distributed generation refers to the generation of electricity conducted by consumers themselves in the consumption center, the main example being the installation of photovoltaic panels in homes and commercial establishments. Until 2022, distributed generation units were partially exempt from paying the Distribution System Usage Tariff (TUSD).

Reduces tax rates (PIS/Pasep and Cofins) levied on materials and equipment for wind sources.

Reduction of tax rates (PIS/Pasep and Cofins) levied on the production and sale of biodiesel, which is a biofuel derived from renewable biomass for use in internal combustion, compression-ignition engines, or for the generation of another type of energy, which can partially or completely replace fossil fuels.

Existing within the Energy Development Account (CDE), the CCC serves the generation of electrical energy in isolated systems, that is, in areas that are not integrated into the National Interconnected System (SIN). The account operates in three ways: I) reimbursement: II) admission of debt contracts and III) subrogation. The CCC finances both renewable and fossil energy, and in this methodology the values are divided between them.

The following are called incentivized sources: wind, biomass, small hydroelectric plants (SHP), hydroelectric generating plants (HGP), photovoltaic and qualified cogeneration. Incentivized electrical energy sources have minimum discounts of 50% in the Tariffs for the Use of Distribution and Transmission Systems (TUSD/TUST).

Promotes the expansion of biofuels in the energy matrix with an emphasis on constant supply. The policy establishes annual national decarbonization targets for the fuel sector to encourage increased production and participation of biofuels in the country’s transport energy matrix.

The program supports the implementation and maintenance of companies whose activities include the conception, development, design, and manufacturing of semiconductor devices and displays through the reduction of PIS/Pasep, Cofins, Import Tax (II), Tax on Industrialized Products (IPI) and Cide. Semiconductors and displays are integral parts of equipment for sources such as wind and solar.

Benefits families and consumer units located in remote regions of the Brazilian Amazon that have not yet had access to public electricity service or that are powered by a non-renewable source of electrical energy. Service in remote regions is provided through renewable sources of electrical energy generation.

Reduction in tax rates (Cide, PIS/Pasep and Cofins) levied on operations conducted with hydrated ethanol.

Recommendations to the Brazilian government

- Brazilian authorities must begin to calculate and disclose all subsidies for energy sources. Today we have a favorable political context both due to the federal executive’s commitment to drafting and implementing the Ecological Transformation Plan, and due to the leadership role that the Lula government assumes within the United Nations Framework Convention on Climate Change (UNFCCC) and as president of the G20 in 2024.

- It is no longer possible for the Brazilian government to continue with the advancement of oil exploration in the Equatorial Margin, justifying itself with a narrative that focuses on the country’s low emissions associated with the burning of fossil fuels and anchored in the renewable matrix of the electrical sector.

- It is necessary to recognize that Brazil is part of the problem of the expansion of global oil production and that the subsidies offered by the federal government to the Oil & Gas sector are an element of pressure for the exploration of new fields since they reduce the extraction costs and increase the profits for the oil companies that operate in Brazil.

- The federal government’s firm action towards reform of fossil fuel subsidies, together with the achievement of zero deforestation, must be the most valuable political anchors for a Brazilian global leadership against climate change.

Select the desired language and download the full executive summary

<< Português >>

<< English >>

Access the full methodology note

<< Português >>

<< English >>

Download the highlights of this analysis

<< Português >>

<< English >>